When transmitting your tax documents this tax season, ask your tax professional to use their secure portal to transfer your documents. We like and use CrushFTP. If your tax professional doesn’t have a portal (probably because they aren’t on KatyCare), you can use PDF-XChange Editor to secure and edit your PDF documents.

If you aren’t sure about learning a new program, or don’t want to pay $30 for PDF-XChange Editor, there is another way. Use Microsoft Word as a secure container. It is helpful to understand that Microsoft Office (Word/Excel/PowerPoint/etc) can be thought of as a container for text, graphics and data. The data can be manually input into Office or you can insert a file into Office programs. If you are typing a Word document about trees, you may drag pictures of trees from your Pictures folder into your document creating a colorful report. When you are done with your report, you may to password protect your report, so you will add a password to your Word document. When you email the document to you taxman, you will provide the password by phone or text message.

Pulling together the concept of a password protected container, follow these steps to securely send your W2 & 1099:

- Gather the documents you are going to send.

- Open Microsoft Word

- Drag the documents you want to secure into the Word document

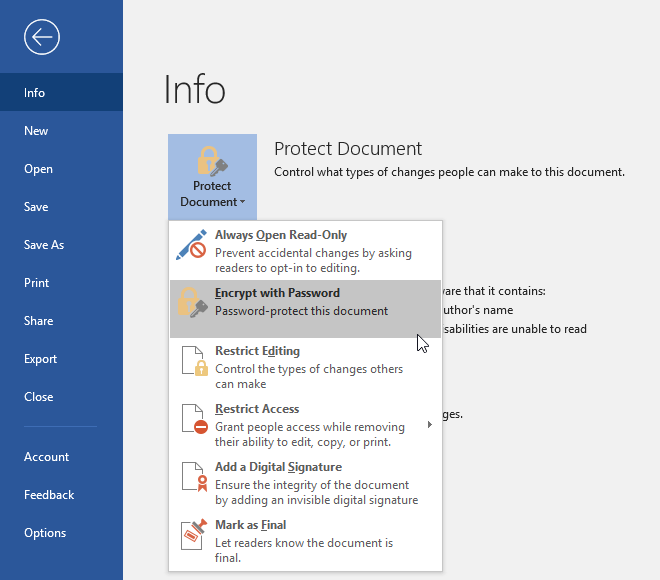

- Secure your document, by clicking: File | Info | Protect Document | Encrypt with Password

- Enter & confirm the password

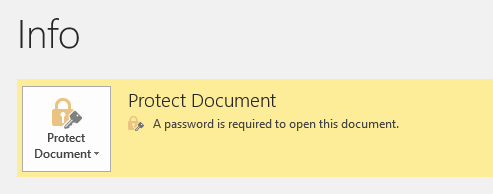

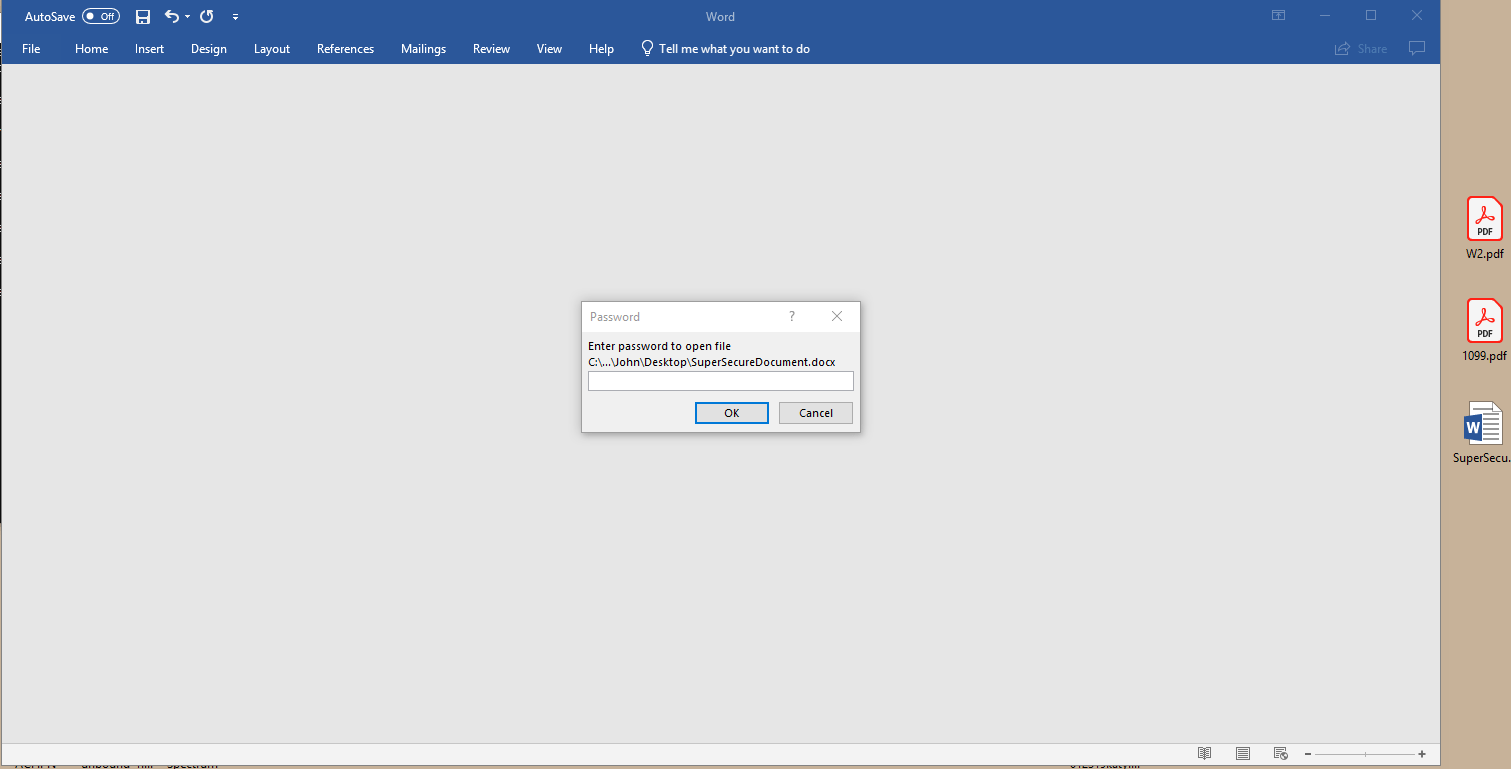

- Save the document, close Word, open the document verifying that a password is required to open the secured document:

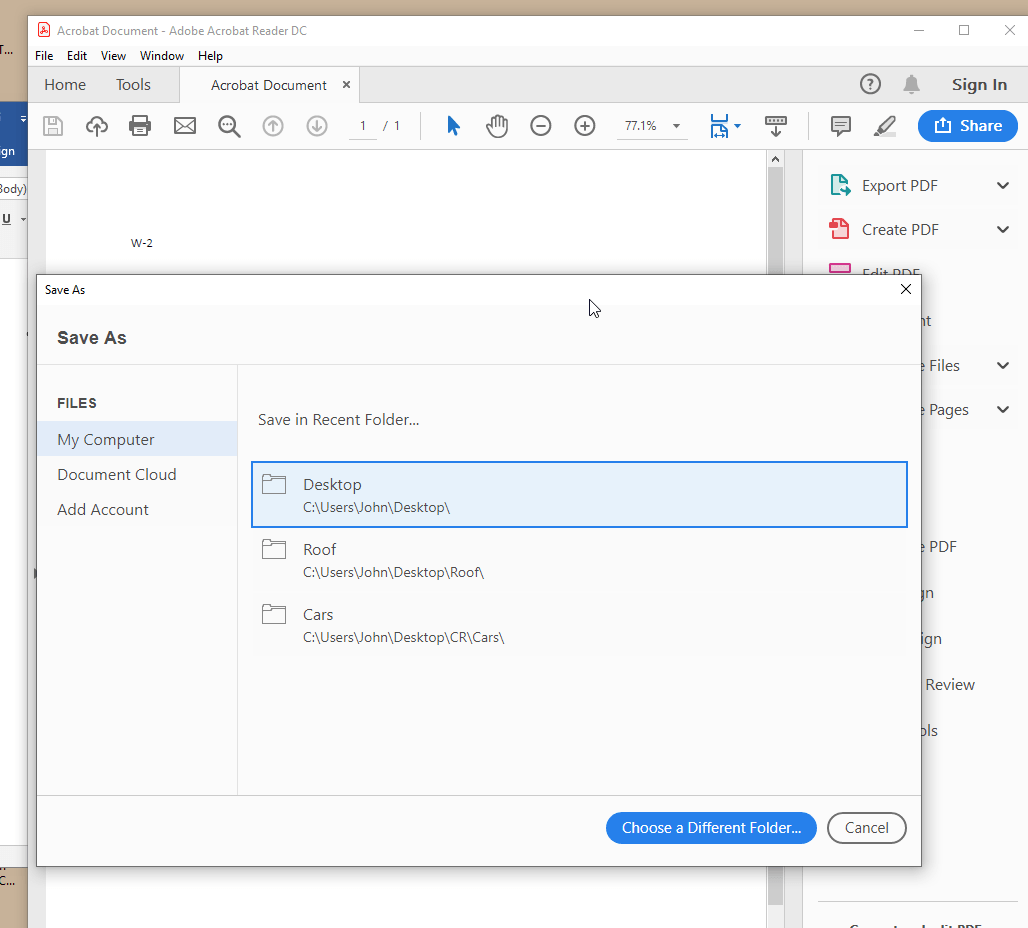

- There are a few ways for your accountant to extract the PDF file you send this way, the most familiar technique is to open the PDF document in Word, then click File | Save As in Acrobat Reader:

- After securing your private documents using a password protected Word document, it is safe to email the document to your accountant. Don’t email the password, pickup the phone.

Let us know if you have questions or need assistance with any of these steps.